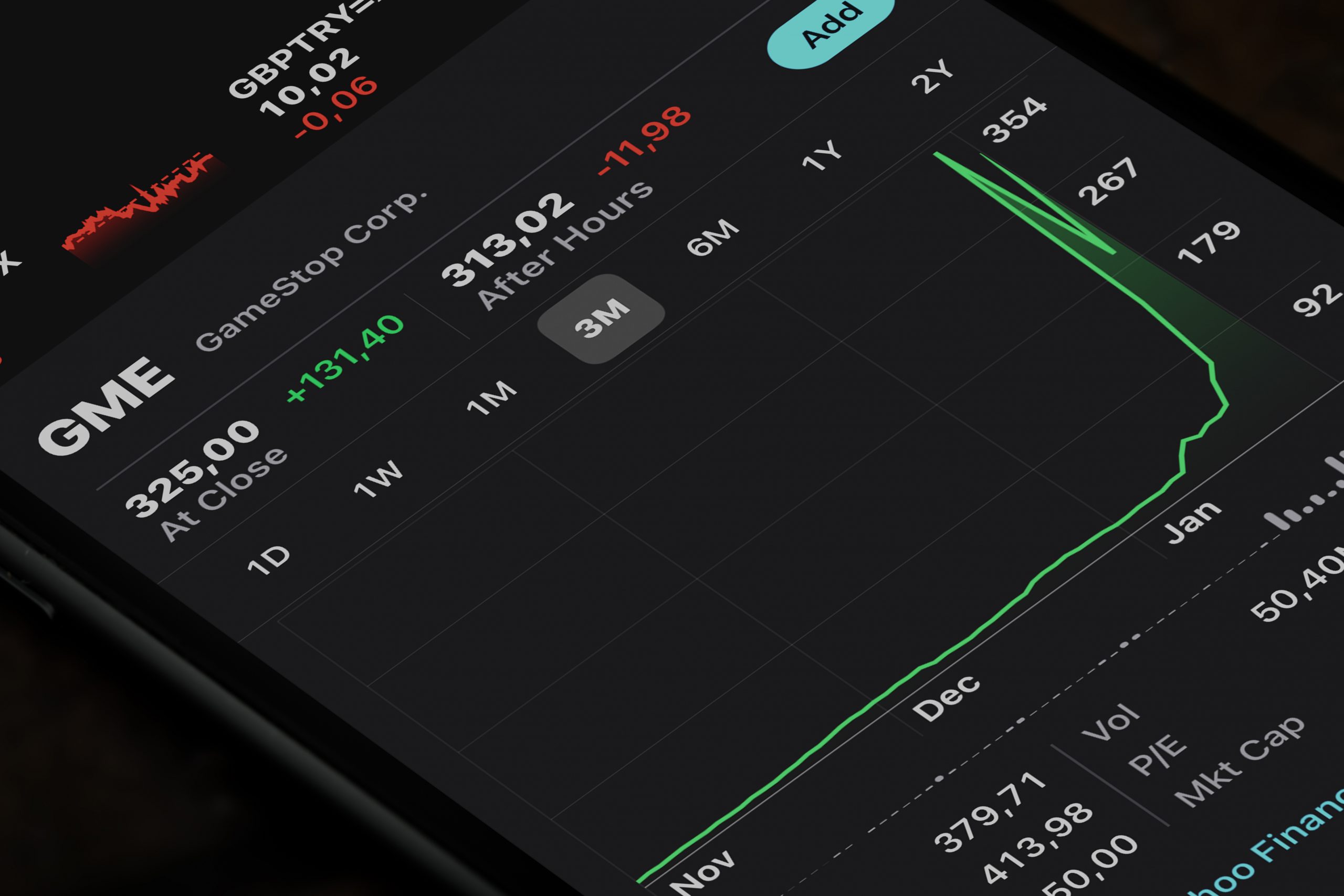

GameStop Saga Puts Focus on Inaccessible Liquidity

February 25, 2021 | By: Ivy Schmerken

In the aftermath of the GameStop trading frenzy, the rise of off-exchange trading volumes that involve routing retail investor orders to dark venues operated by market makers, has attracted scrutiny as liquidity has moved away from the public exchanges.

At the House Financial Services Committee hearing on Feb. 18, lawmakers questioned chief executives from Robinhood and Citadel Securities about off-exchange trading volumes in U.S. stocks eclipsing 50%. Off-exchange volume hit 50.5 %, an all-time high for a single day of trading, based on data from Rosenblatt Securities, reported the Wall Street Journal on Feb. 12 in “GameStop Mania Highlights the Shift to Dark Trading.” (For the month ending Feb. 24, off-exchange trades accounted for 47.5% of the volume, as compared to 52.4% for exchanges, according to Cboe Global Markets statistics.)

The hearing focused on winners and losers in the manic trading of GameStop, AMC Entertainment Holdings, and other “meme stocks” touted on social media, the rules around short selling, and whether retail investors were treated fairly when Robinhood restricted trading on Jan. 28 on purchases of GameStop and in other stocks. Amid extreme volatility, the online broker curtailed trading to meet collateral requirements for its clearing broker at the Depository Trust & Clearing Corp. But the hearing repeatedly turned the spotlight on the practice of retail brokers sending their order flow to market makers in what’s known as payment-for-order flow or PFOF.

Defending its business model, Robinhood’s CEO Vlad Tenev testified that the online broker routes customer orders to seven market makers including Citadel Securities to receive best execution.

“In 2020, Robinhood provided our customers in excess of $1 billion in price improvement which is measured relative to the NBBO – national best bid and best officer – the reference price on all major lit exchanges,” said Vlad Tenev, CEO at Robinhood Markets at the hearing.

Kenneth Griffin, founder of Citadel Securities, said the firm handles roughly 40% of the retail volume in U.S. stocks. He testified the firm had invested “hundreds of millions of dollars in its systems,” and that it competes with other market makers for retail order flow. Collectively, market makers last year delivered $3.7 billion in price improvement, he said.

Inaccessible Liquidity

Even prior to the frenzy around GameStop, market observers were raising concerns about the increasing retail volumes being routed to private venues known as internalization.

“Off-exchange trading has seen an inexorable rise,” said Shane Swanson, senior analyst, Market Structure and Technology at Greenwich Associates on Jan. 12 during a webinar. In 2020, the market breached 40% in average daily volume in off-exchange trading and exchange trading became less than 50%, noted Swanson, adding: “That is a massive change.”

But analysts have expressed concerns about price discovery on lit markets. “If you see so much equity trading go off-exchange it could have an impact on price discovery,” said Swanson. However, Swanson added, “We haven’t seen the market metrics showing that this is a problem.”

On Jan. 11, the New York Stock Exchange (NYSE) wrote that the increase in retail trading activity is causing challenges for institutional trading and liquidity. “Displayed liquidity is critical to the success of the US equity markets. Under today’s set of market rules and procedures, however, trading away from transparent exchanges is at an all-time high,” wrote the NYSE in its blog.

With the surge in retail activity since the pandemic fueled by investors staying at home, a spike in day traders, and mobile apps gamifying the trading experience, this has become 25% of the total market volume. However, with the activity traded bilaterally between market makers and brokers, some market participants cannot directly interact with it, the NYSE noted.

[For more background on off-exchange trading, Read our blog “Equity Market Structure Wrestles with Inaccessible Liquidity based on discussions from the STA Market Structure conference.]

“The challenge is approximately 20%-plus of equity volume is not normally accessible, “said David Cannizzo, Managing Director, Head of Electronic Trading at Raymond James, whose firm executes orders on behalf of retail investors and institutions. The problem is: “What do you do about it and how do you access it?” said Cannizzo.

Prior to 2020, well over half the volume was traded on the major exchanges. “Today, slightly more than half of US equity volumes trade on exchange with the other approximate 45% going off-exchange,” said Cannizzo. The GameStop situation with so many retail investors pouring into stocks and options, has brought this to the forefront of market structure discussions,” he said.

In the past, over 60% of volume was on exchanges and 10% to 15% was on dark pools, with the balance being traded upstairs or through wholesalers. However, a portion of dark pool liquidity is not accessible intraday because of mechanisms like trajectory/VWAP crosses, which could print trades at the end of day, he said, referring to crosses at the volume weighted average price.

Institutional Algos Pay the Price

Now experts are saying this is costing institutional investors three times as much in transaction costs, and it’s affecting the calculations made by certain algorithms such as VWAP and percentage of volume or POV, which rely on accessing overall volumes.

“With the PFOF model, all the order flow that is transacted through market makers like Citadel Securities and Virtu doesn’t even touch the big exchanges. For an institution – and these are representing retirement funds, pension funds and 401k investors – it puts that supply-demand equation out of whack,” said Linda Giordano, partner at GTA Babelfish LLC in an interview.

When institutional investors buy or sell stocks like Apple, American Airlines or Boeing, with a high component of individual trading activity, the transaction costs are three times higher than for stocks that have less than 10% of their volume coming from retail investors, according to GTA Babelfish LLC, a provider of transaction cost and venue/routing analysis in a blog “Meme Stocks: Inaccessible Trading Share, Trading Cost and Risk.”

According to the firm’s analysis from July through December 2020, a stock with 31-34% of its volume tied to retail market share would move the execution price by 34 basis points (bps), or three times the cost for a stock with less than 10% retail market share, which added 10 bps.

“It’s become a lot more complicated with institutional money managers to trade without costs. In the short term, you can’t just put a list of stocks in a VWAP algo or participate at X%. You have to weed out the ones that have a higher retail share and these are the ones that have a lower retail share, and trade them in different ways,” said Giordano.

It’s not just fringe meme stocks; the problem is occurring in popular names such as Boeing, American Airlines, Roku, Tesla, Peloton, Moderna, and AMD, said Jeff Alexander, partner at GTA Babelfish. Even Apple is 38% retail and Zoom is 32%. “Those are just a few,” said Alexander, adding, “There are a lot of big index names in there.”

It’s also hard to find high retail stocks in institutional dark pools, said Alexander. “They’re out there, but they tend to be less well-known names,” he said. For example, there are stocks in the Russell 3000 index such as Money Gram International, Magnite Inc., and Exelon Therapeutics, that have high retail activity as well as 10% or more of their volume traded in a dark pool.”

According to Raymond James’ Cannizzo, “The question still remains whether the names traded by institutions and retail overlap to a large degree? If that is the case, then are a large percentage of the volumes in institutional names actually inaccessible? In the names where they do overlap though, POV type strategies may be reacting to volumes and prints that are inaccessible to the strategy and thereby impacting prices more than they realize,” he said. “Traders may want to consider lowering their participation targets in an attempt to offset this impact,” he added.

Giordano said that institutions had to adjust their trading strategies such as by choosing algorithms that are more lit-focused because they are creating more market impact in dark pools. The increase in retail market share executed off-exchange has left retail market share in other segments compressed, said Giordano.

Looking at a ranking of the top 10 venues, four of top 10 are market makers—Citadel Securities is No. 1 ahead of Nasdaq at No.2, and Virtu Americas ranks third ahead of NYSE and NYSE Arca, which occupy fourth and fifth place respectively. Next, G1 Execution Services sits at No. 7 between Cboe’s EDGX Equities at No. 6 and BZX Equities at No. 8, and IEX is in ninth place followed by Two Sigma at No. 10. Giordano noted there are no dark pools among the top 10 market participants.

Since April, an institution trading a stock like Apple in a dark pool or IEX, “had enough cushion” so their activity would blend in, said Giordano. What’s happened since then, said Giordano, is that as the retail participation increased on off-exchange venues, the market share in dark pools and IEX has become compressed, so there is less of a cushion in safe, low-cost venues and more likelihood of an institution causing adverse price movement.

Institutions Seek Solutions

Meanwhile, sell-side firms are looking for technology solutions to access this “inaccessible” liquidity, and this includes talking to bulge-bracket firms about tapping into their central risk books, which trade millions upon millions of shares per day, said Cannizzo.

“From my seat, we are certainly actively discussing the topic of inaccessible liquidity. We’re trying to come up with some ideas on how to solve for it in a creative way,” said Cannizzo.

As the sixth largest retail broker in the nation, Cannizzo is exploring how it could deliver its own inaccessible liquidity to its institutional clients. “That’s the puzzle we’re trying to solve for,” he said.

Since Raymond James’ different business lines span retail, institutional, high-net worth in the equity space, Cannizzo been working on using the firm’s algo platform to deliver its own inaccessible liquidity to its institutional clients.

“We currently have a mechanism built into our algos that does that with our own (eligible retail) flows,” said Cannizzo, noting that this has been active since Nov. 1st.

To potentially broaden the effort, Cannizzo is looking at how an institutional algo can wrangle in different retail flows, such as market makers, block desks, and central risk books. “The challenge is how to efficiently implement something like this while accounting for the possibility of information leakage,” he said. “The whole subject of inaccessible liquidity is a topic that is known to be problematic, but it feels like it has been somewhat accepted because of the difficulty of efficiently addressing it,” he said.

Meanwhile, the GameStop mania has raised several issues and lawmakers plan to hold additional hearings with the SEC and FINRA in the coming months. It remains to be seen if regulators will take any steps to address off-exchange liquidity in the near term, or whether it will end up in a study of PFOF that will examine the overall impact. In the long term, the industry could rely on regulators to divert retail volume back to the public markets, or the market could innovate to develop a solution.