Fixed-Income Trading Technology on the Verge of Change

The journey to adopting a Fixed Income Execution Management System is accelerating, and firms are seizing the opportunity to evolve at a faster pace. In a recent survey conducted by Coalition Greenwich in collaboration with FlexTrade, US-based buy-side clients revealed key drivers behind EMS adoption.

What to Expect

As time-consuming and inefficient processes need to be remediated, fixed-income trading technology is set to evolve at a faster pace. Buy-side users of EMS technology are huge advocates for automation and electronification and use the EMS as a hub for the buy side, the trading venues, and their dealer counterparties.

This paper explores the current state of the fixed-income markets while tackling the pain points that drive buy-side participants to adopt electronification.

Topics Include

| The State of Fixed-Income Markets | |

|---|---|

| Trading Technology Pain Points | |

| The Changing Technology Landscape | |

| Modernizing Fixed-Income Trading is a Marathon Methodology |

Key Findings

- Significant trading technology changes are coming, and fixed-income trading technology is set to evolve at a faster pace in 2024.

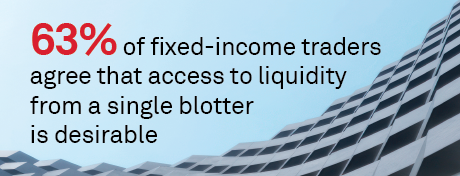

- Technology pain points are pushing traders to seek more effective ways to trade.

- The shift to more electronification is motivated by both asset class “readiness” as well as improved attitudes towards e-trading.

- Traders are set to exploit advanced technology through EMS adoption fostering an overall better user experience.