A Fully-Integrated Digital Asset Solution

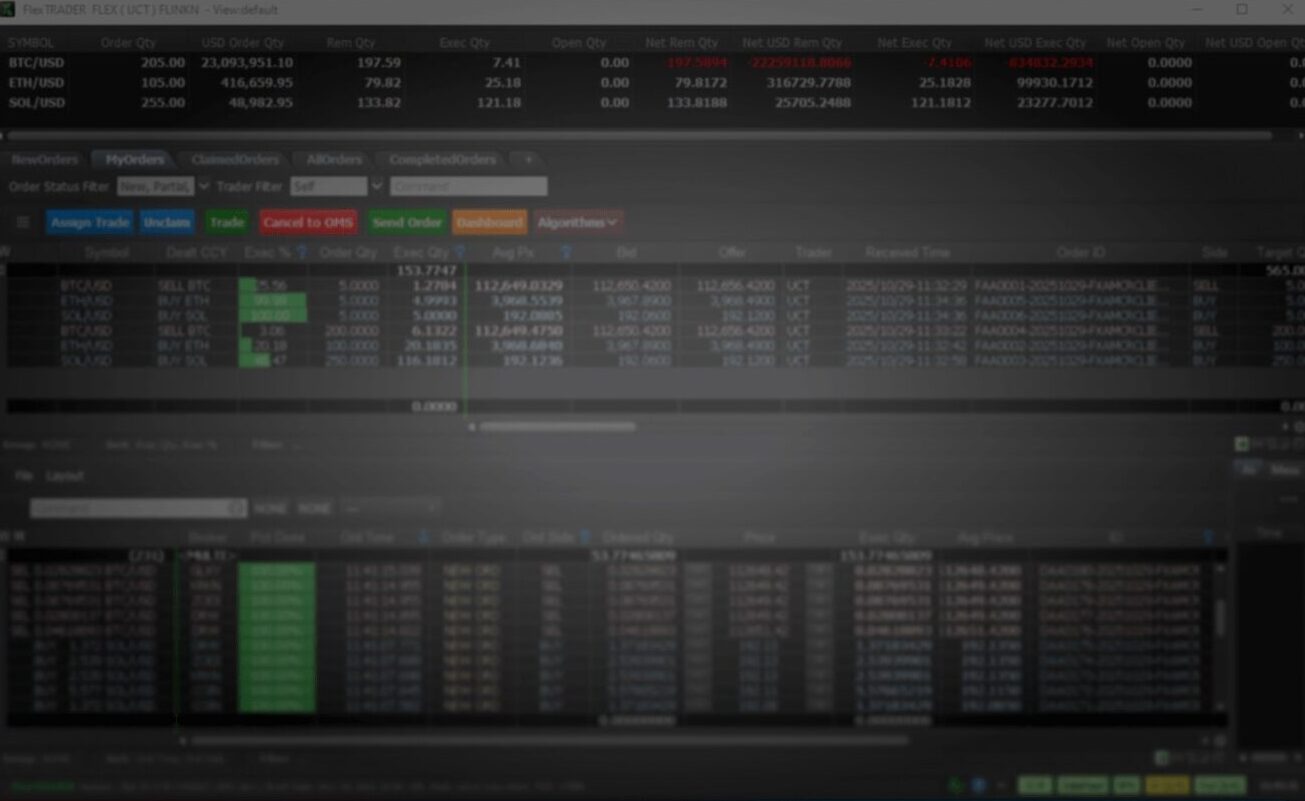

FlexDigitalAssets brings institutional-grade liquidity management, execution, and analytics for digital assets to FlexTRADER EMS and FlexONE clients.

FlexDigitalAssets brings institutional-grade liquidity management, execution, and analytics for digital assets to FlexTRADER EMS and FlexONE clients.

FlexDigitalAssets provides seamless access to liquidity across top Digital Asset exchanges and market makers, allowing for efficient trade execution, all within existing OMS and EMS systems.

Get a holistic view of crypto and digital asset positions alongside other asset classes to understand your exposures and real-time PnL from a single screen.

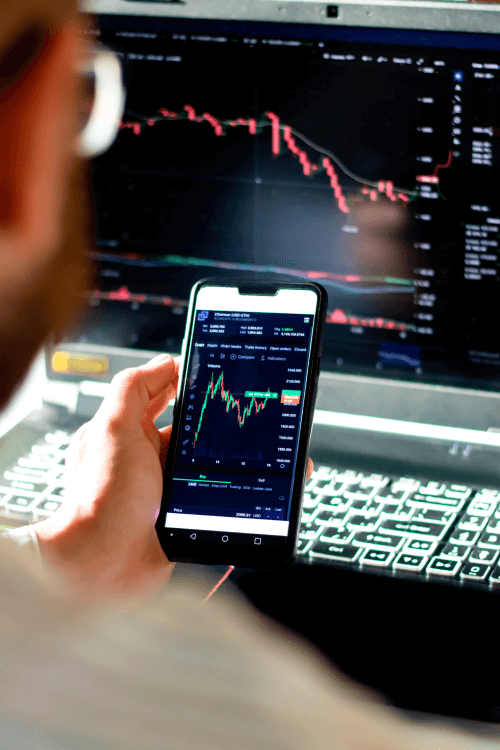

FlexDigitalAssets delivers a low-friction experience for multi-asset or crypto-specific trading desks to optimize decision-making and improve control.

FlexTrade’s robust APIs seamlessly connect with ABOR/IBOR downstream systems, such as proprietary portfolio accounting systems and external custody and wallet providers, to improve efficiency and streamline the settlement process for digital assets and cryptocurrencies.

FlexDigitalAssets offers algos that optimize maker/taker fees, as well as Voice and RFQ tools to interact with OTC desks. Upcoming integrations with custody and wallet providers will give our clients direct access to DeFi protocols.

Digital asset adoption accelerates the need for institutional-grade trading platforms and other infrastructure—such as smart order routers and algorithms through an OEMS—to source liquidity across various crypto exchanges and venues.

FlexDigitalAssets brings these new asset classes into institutional portfolios to help clients achieve the seamless workflows and settlement connectivity they've come to expect from their OEMS.

| Challenge | Solution |

|---|---|

| ChallengeLack of native digital asset trading functionality within current EMS/OEMS solutions. | Solution FlexDigitalAssets allows FlexTrade clients to directly access various pools of liquidity for digital assets, providing seamless connectivity, consolidated depth of book, and order placement from within FlexTRADER EMS and FlexONE. |

| ChallengeLack of integrations with broker platforms that specialize in cryptocurrency and digital assets. | Solution FlexDigitalAssets integrates directly with exchanges and market makers, including Coinbase Prime. |

| ChallengeEfficiently trading cryptocurrencies is challenging without aggregated market access and algorithmic tools. | Solution FlexTrade's clients can source digital asset liquidity from leading exchanges and market makers into FlexTrade's aggregator (Spots & Derivatives), streaming or RFQ prices, and execute directly through FlexTrade via click trading or proprietary crypto algos. |

| ChallengeThere isn't an easy way to view crypto and digital asset positions alongside other asset classes. | Solution Using FlexDigitalAssets, clients can holistically view crypto and digital asset positions alongside other asset classes to understand their exposures and real-time PnL from a single screen. |

| ChallengeAccess to localized cryptocurrency products is required. | Solution In addition to Spots, ETFs, and Futures, FlexTrade's global presence allows us to offer products that cater to regional markets, such as Bitcoin and Ethereum Perpetual Futures in Europe and Asia. |

Press Release

With the integration to Coinbase Prime, FlexTrade clients can directly access one of the largest pools of liquidity for digital assets via FlexTRADER EMS and FlexONE OEMS. The integration provides seamless connectivity, consolidated depth of book, and order placement from within FlexTRADER and FlexONE.

Solutions For Digital Assets Trading

Offering cutting-edge product capabilities and rapid deployment to maximize the potential of your multi-asset trading desk.

Achieve superior digital asset trading efficiency with FlexTrade’s cutting edge trading technology, addressing fragmentation and enabling electronic protocol access.

Boost digital asset trading efficiency with FlexONE, a unified buy-side platform that integrates operations, market data, and risk with portfolio management and trading in real time.